stock sell off end of year

The second opportunity to profit traces to the tendency of stocks sold in December to bounce back in the New Year. Your sale of stock at a loss coupled with the repurchase of the same stock within 30 calendar days after the sale would trigger the wash-sale rules disallowing the capital loss.

Psychology Of What Could Happen The Next 4 Year With The Market Stock Market Stock Market Data Marketing Data

The last day to sell stocks for a tax loss in 2020 is probably December 28 or 29 if your broker will settle the transaction before December 31.

. In a typical year the SP 500 returns an average of 15 for investors. But after a solid start to December and a historic run off the March lows some traders are getting concerned about. Less-than-truckload stocks were the.

3 hours agoWhile TL stocks have sold off from recent highs its the less-than-truckload sector thats underperforming the broader market and transports. Things get more complicated if youre waiting for a short sale transaction to settle The other rule for. Its generally not a good idea to sell stocks when theyre down but that applies in situations when the market tanks on a whole.

Target stock has plummeted about 285 since its report after trading roughly flat for the year and Walmart stock is down 175 since its report erasing what had been a. Investors looking for December profit-taking may see the exact opposite. There are losing stocks out there.

Predict the overall performance of the. I believe the stock price has fallen faster than the anticipated lower median target price making Boeing a. There are some caveats to all of this.

However at tax time these capital losses can. Investors enjoyed huge returns in the month of November. Institutional Investors want to show in their end of year holdings they are picking winners so they tend to sell losers and accumulate stocks that performed well during the year.

When the SP 500 is up at. To begin with understand that sell-offs and corrections ie declines of at least 10 from a recent high happen with more frequency than you. Frustrated investors got no relief in April as US.

The Nasdaq Composite tumbled 133 in April the indexs worst monthly performance. A rise in VIX means heavy put. The yield on the 10-year Treasury note TMUBMUSD10Y 2828 was at 282 compared with 2785 at 3 pm.

Other retailers took a hit on the back of Targets quarterly earnings miss with the SPDR SP Retail ETF falling 84. The January Effect is the tendency for stock prices to rise in the first month of the year following a year-end sell-off for tax purposes. You may therefore want to get back into the stocks you sold.

Plummeting stock prices can cast a dark cloud over anyones finances. Dump losing stocks to reap the tax benefits. Indeed the New York Stock Exchange Advance Decline lines NYAD ended last week flat while the CBOE Volatility Index VIX rolled over.

Stock markets fell deeper into the red. 1 day agoWhat yields are doing. Amazons stock price dropped 72 and Best Buys stock.

The end of year sell off is to sell of stocks that people have lost money on. Something is loading. Although the SP 500 has gained more than 5 year-to-date it has been a bifurcated market with many stocks down.

Year-end tax move. These include Q1 2018 Q3 2019 and the 2020 COVID-19 sell-off. Sell stocks to harvest losses.

For example if you bought SHOP before the Citron story and held youd be selling that off in this instance. Yields and debt prices move. Stocks are poised for a year-end and early-2022 rally as the recent sell-off appears overdone and hints at moves by short sellers who will soon get.

/TheImpactofRecessionsonInvestors2-d2388f716d944e9898e617e7dfd5beaf.png)

How Do Recessions Impact Investors

Market Wrap Year End Review When Institutions Cashed Out Of Bitcoin Bitcoin Price Bitcoin Renewable Energy Resources

Owning U S Homes Pays Off As Equity Beats Mortgage Debt Mortgage Debt Mortgage Equity

Little Bighorn Stock Market Investing In Stocks Stocks For Beginners

Stocks Fall Slightly On Monday As Investors Brace For Earnings Reports Impact From Higher Rates

Quarter End Markets Summary 6 Charts And Tables On The Q2 Rebound In Risk Morningstar Rebounding Marketing Corporate Bonds

Best Time S Of Day Week And Month To Trade Stocks

The Best Performing Stocks In The Last 10 Years Spendmenot

The Best Performing Stocks In The Last 10 Years Spendmenot

Best Time S Of Day Week And Month To Trade Stocks

How To Buy Sell Stocks For Beginners Sapling Finance Investing Investing In Stocks Stocks For Beginners

Best Time S Of Day Week And Month To Trade Stocks

/stocks_istock522868024-5bfc47b946e0fb002607e1ed.jpg)

Best Time S Of Day Week And Month To Trade Stocks

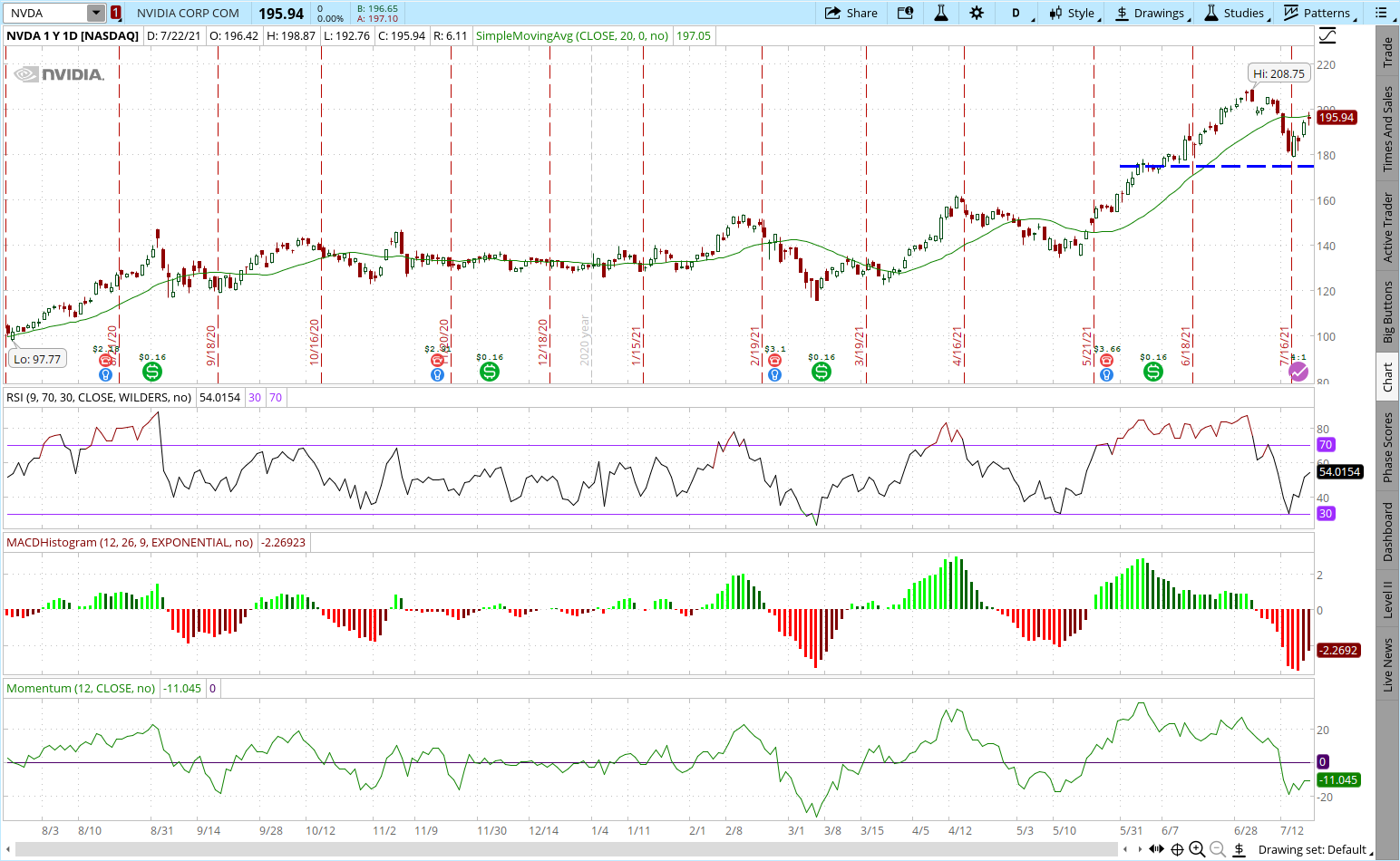

Nvda Stock Is Ready To Rally After The Recent Sharp Sell Off

Are You Guilty Of These 3 Bad Investor Behaviors Investing Infographic Finance Investing Investing

:max_bytes(150000):strip_icc()/dotdash_INV-final-Stock-Market-Crash-July-2021-01-88a96c7bec2846dd9986a5777c089417.jpg)

:max_bytes(150000):strip_icc()/why-would-company-buyback-its-own-shares_FINAL-dc32eefe564647ce9c66c345230fd0a9.png)